UNITED STATES

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

SCHEDULE 14A |

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒ | |

Filed by a Party other than the Registrant ☐ | |

| |

Check the appropriate box: | |

|

|

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Pursuant to Rule §240.14a-12 |

J&J & J SNACK FOODS CORP.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ | No fee required. | |

|

|

|

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

|

|

|

| 1. | Title of each class of securities to which transaction applies: |

|

|

|

|

|

|

| 2. | Aggregate number of securities to which transaction applies: |

|

|

|

|

|

|

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

|

|

|

|

| 4. | Proposed maximum aggregate value of transaction: |

|

|

|

|

|

|

| 5. | Total fee paid: |

|

|

|

|

|

|

|

| SEC 1913 (04-05) Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

|

|

|

☐ | Fee paid previously with preliminary materials. | |

|

|

|

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

|

|

|

| 1. | Amount Previously Paid: |

|

|

|

|

|

|

| 2. | Form, Schedule or Registration Statement No.: |

|

|

|

|

|

|

| 3. | Filing Party: |

|

|

|

|

|

|

| 4. | Date Filed: |

|

|

|

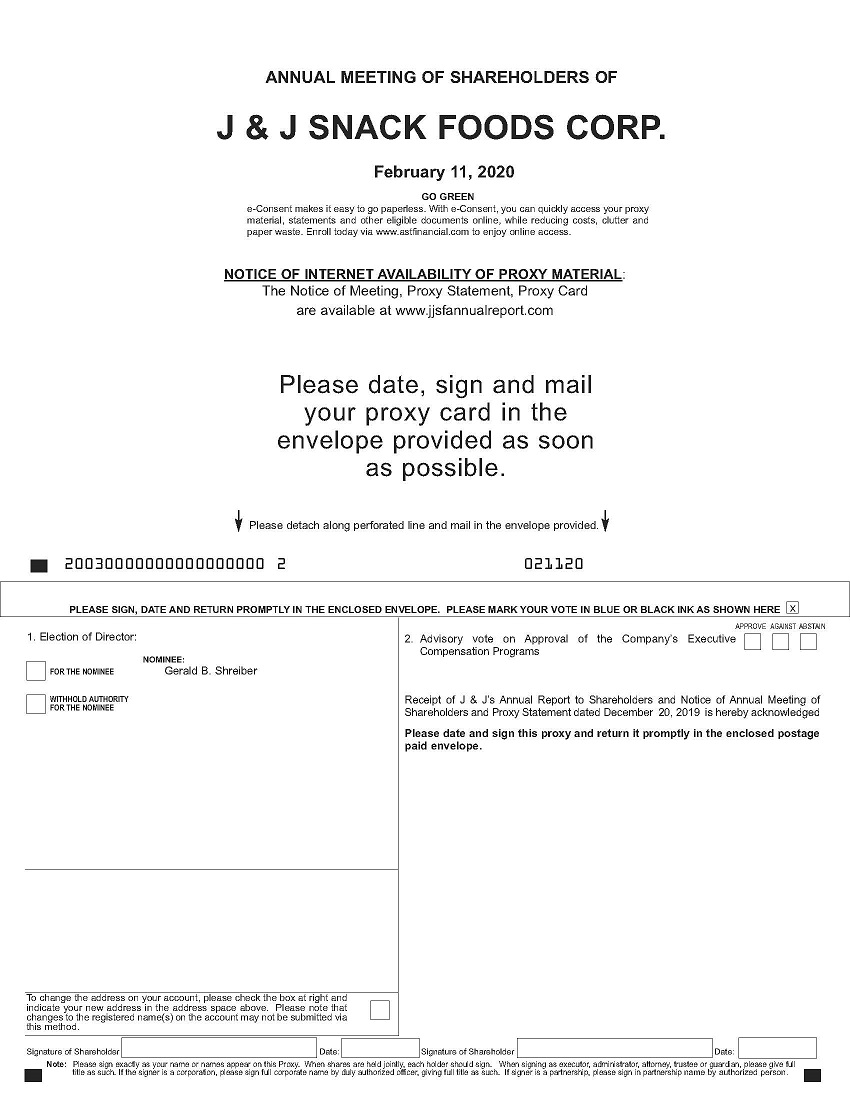

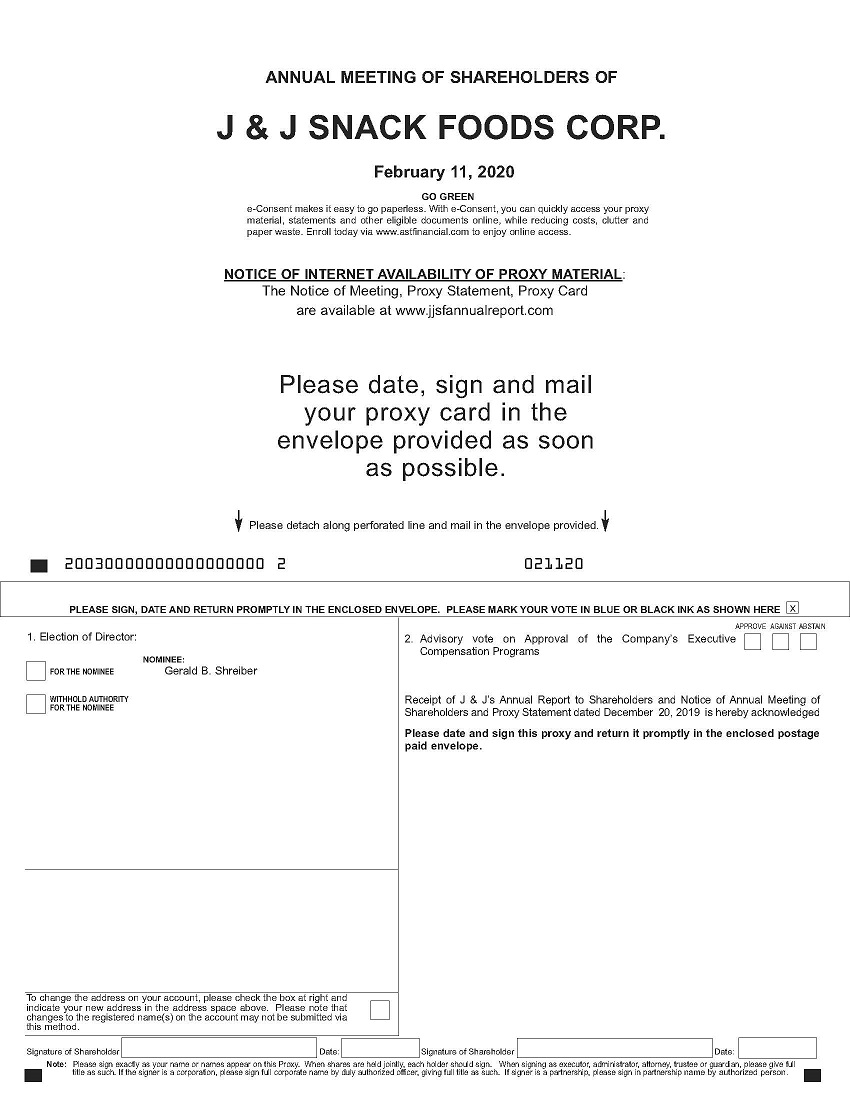

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

February 11, 202016, 2022

TO OUR SHAREHOLDERS:

The annualAnnual Meeting of Shareholders of J & J SNACK FOODS CORP. will be held virtually on Tuesday,Wednesday, February 11, 202016, 2022, at 10:00 A.M., E.S.T., at The Crowne Plaza, 2349 West Marlton Pike (Route 70), Cherry Hill, New Jersey 08002 for the following purpose:

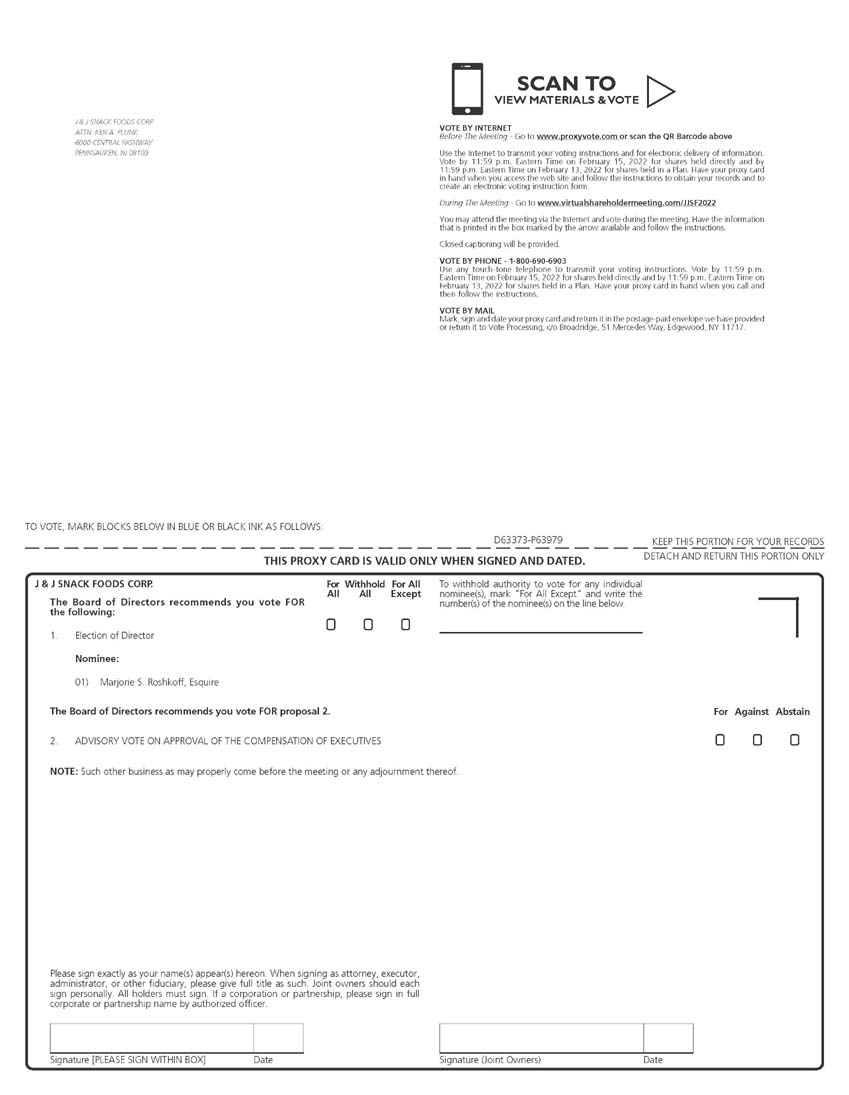

1. To elect one director;

2. To have an advisory vote on the approval of compensation of the Company’s named executive officers; and

3. To consider and act upon such other matters as may properly come before the meeting and any adjournments thereof.

The Board of Directors has fixed December 13, 201920, 2021, as the record date for the determination of shareholders entitled to vote at the Annual Meeting. Only shareholders of record at the close of business on that date will be entitled to notice of, and to vote at, the Annual Meeting.

Due to the continuing public health impact of the COVID-19 pandemic and to support the health and well-being of our employees and shareholders, we are pleased to provide shareholders with the opportunity to participate in the Annual Meeting online via the Internet in a virtual-only meeting format to facilitate shareholder attendance and provide a consistent experience to all shareholders regardless of location. We will provide a live webcast of the Annual Meeting at www.virtualshareholdermeeting.com/JJSF2022, where you will also be able to submit questions and vote online. You will not be able to attend the meeting at a physical location. Closed captioning will be provided for the virtual meeting.

YOU ARE CORDIALLY INVITED TO ATTEND THE ANNUAL MEETING IN PERSON.ONLINE. WHETHER OR NOT YOU EXPECT TO ATTEND THE ANNUAL MEETING IN PERSON, YOU ARE URGED TO SIGN, DATE AND PROMPTLY RETURN THE ENCLOSED PROXY. A SELF-ADDRESSED, STAMPED ENVELOPE IS ENCLOSED FOR YOUR CONVENIENCE. NO POSTAGE IS REQUIRED IF MAILED IN THE UNITED STATES.

By Order of the Board of Directors, |

| ||

|

| ||

/s/ Marjorie S. Roshkoff | |||

Marjorie S. Roshkoff, Esquire | |||

Secretary |

December 20, 2019

TABLE OF CONTENTS

Page

PROXY STATEMENT | 1 |

PROPOSAL 1 – INFORMATION CONCERNING NOMINEE FOR ELECTION TO BOARD | |

INFORMATION CONCERNING CONTINUING DIRECTORS AND EXECUTIVE OFFICERS | |

CORPORATE GOVERNANCE | |

BENEFICIAL OWNERSHIP OF SHARES | |

COMPENSATION DISCUSSION AND ANALYSIS | |

EXECUTIVE COMPENSATION SUMMARY COMPENSATION TABLE | |

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END | |

GRANTS OF PLAN-BASED AWARDS IN FISCAL | |

OPTION EXERCISES | |

TRANSACTIONS WITH RELATED PERSONS | |

CERTAIN TRANSACTIONS | |

POTENTIAL PAYMENT UPON TERMINATION OR CHANGE IN CONTROL | |

REPORT OF THE AUDIT COMMITTEE | |

INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS | |

PROPOSAL 2 | |

OTHER MATTERS | |

ANNUAL REPORT TO SHAREHOLDERS AND FORM 10-K |

ABOUT THE MEETINGPROXY STATEMENT

Why did you send me this proxy statement?

WeJ & J SNACK FOODS CORP. (“J & J”, the “Company” or “we”) sent this proxy statement and the enclosed proxy card to you because our Board of Directors is soliciting your proxy to vote at the 2020virtual 2021 Annual Meeting of Shareholders.Shareholders (the “Annual Meeting”). This proxy statement summarizes information concerning the matters to be presented at the meeting and related information that will help you make an informed vote at the meeting. This proxy statement and the accompanying proxy card are first being mailed to shareholders on or about December 23, 2019.27, 2021.

When is the annual meeting?Annual Meeting?

The annual meetingAnnual Meeting will be held on Tuesday,Wednesday, February 11, 202016, 2022, at 10:00 a.m.A.M., EST, atE.S.T. The Crowne Plaza, 2349 West Marlton Pike (Route 70), Cherry Hill,Annual Meeting will be held via a live webcast, and there will not be a physical meeting location. You will be able to attend the Annual Meeting online and to vote your shares electronically on the virtual meeting platform by visiting www.virtualshareholdermeeting.com/JJSF2022 and entering the 16-digit control number included on your proxy card or in the instructions that accompanied your proxy materials. We have decided to have the shareholder meeting remotely due to the continuing global COVID-19 pandemic. Additionally, New Jersey.Jersey law has amended the New Jersey Business Corporation Act of New Jersey (“NJBCA”) to permanently allow remote shareholder meetings, as long as the Board of Directors approve such and follows the required guidelines, which it has done.

We encourage you to access the Annual Meeting before it begins. Online check-in will start approximately 15 minutes before the Annual Meeting on February 16, 2022. If you have difficulty accessing the meeting, please call the technical support number that will be posted on the Annual Meeting login page. We will have technicians available to assist you.

What am I voting on?

At the annual meeting,Annual Meeting, you will be voting:

● | To elect one director for a five-year term; |

● | On an advisory vote on approval of the compensation of executives; and |

● | On any other |

How do you recommend that I vote on these items?

The Board of Directors recommends that you vote:

● | FOR the director nominee. |

● | APPROVE on the advisory vote approving executive compensation. |

Who is entitled to vote?

You may vote if you owned our common share(s) as of the close of business on December 13, 2019,20, 2021, the record date for the annual meeting. On the record date, there were 18,899,32919,088,832 shares of J & J common stock, no par value (“Common StockStock”) outstanding.

Who pays expenses related to the proxy solicitation?

The expenses of the proxy solicitation will be borne by J & J Snack Foods Corp. (“J & J” or the “Company”).J. In addition to solicitation by mail, proxies may be solicited in person or by telephone by directors, officers or employees of J & J and its subsidiaries without additional compensation. J & J may engage the services of a proxy-soliciting firm. J & J is required to pay the reasonable expenses incurred by record holders of J & J common stock, no par value (“Common Stock”),Stock, who are brokers, dealers, banks or voting trustees, or their nominees, for mailing proxy material and annual shareholder reports to the beneficial owners of Common Stock they hold of record, upon request of such recordholders.

How many votes are needed to elect a director?

Pursuant to the New Jersey Business Corporation Act (the “NJBCA”),NJBCA, the election of directors will be determined by a plurality vote and the one (1) nominee receiving the most “FOR” votes will be elected. If any nominee for director in an uncontested election receives a greater number of votes “withheld” than votes “for” such election, our Director Resignation Policy requires that such nominee must promptly tender his or her resignation to the Board following certification of the vote, which the Board shall accept or reject within 90 days of the shareholder vote.

Approval of any other proposal will require the affirmative vote of a majority of the votes cast on the proposal.

What constitutes a quorum?

The holders of a majority of the aggregate outstanding shares of Common Stock, present either in person or by proxy, will constitute a quorum for the transaction of business at the Annual Meeting and at any postponement or adjournment of the Annual Meeting. Pursuant to the NJBCA, abstentions and broker non-votes (described below) will be counted for the purpose of determining whether a quorum is present.

What is the effect of abstentions and broker non-votes?

Under the NJBCA, abstentions, or a withholding of authority, or broker non-votes, are not counted as votes cast and, therefore, will have no effect on any proposal at the Annual Meeting. Brokers who hold shares for the accounts of their clients may vote such shares either as directed by their clients or in their own discretion if permitted by the applicable stock exchange or other organization of which they are members. Members of the New York Stock Exchange (“NYSE”) are permitted to vote their clients’ shares in their own discretion as to certain “routine” matters if the clients have not timely furnished voting instructions prior to the Annual Meeting. The election of directors is not considered a routine matter. When a broker votes a client’s shares on some, but not all, of the proposals at a meeting, the omitted votes are referred to as “broker non-votes.” In the election of directors, if any nominee for director in an uncontested election receives a greater number of votes “withheld” than votes “for” such election, our Director Resignation Policy requires that such nominee must promptly tender his or her resignation to the Board following certification of the vote, which the Board shall accept or reject within 90 days of the shareholder vote.

How do I vote my shares?

If you are a registered shareholder (that is, if your stock is registered in your name), you may attend the Annual Meeting and vote in persononline or vote by proxy. To vote by mail - mark, sign and date your proxy card and return such card in the postage-paid envelope J & J has provided you.

If you hold your shares in street name (that is, if you hold your shares through a broker, bank or other holder of record), you will receive a voting instruction form from your broker, bank or other holder of record. This form will explain which voting options are available to you. If you want to vote in person at the annual meeting, you must obtain an additional proxy card from your broker, bank or other holder of record authorizing you to vote. You must bring this proxy card to the meeting.

J & J encourages you to vote your shares for matters to be covered at the Annual Meeting.

What if I do not specify how I want my shares voted?

If you submit a signed proxy card but do not indicate how you want your shares voted, the persons named in the enclosed proxy will vote your shares of Common Stock:

● | “for” the election of the nominee for director; |

● | “approve” the advisory vote approving executive compensation; and |

● | with respect to any other matter that properly comes before the Annual Meeting, the proxy holders will vote the proxies in their discretion in accordance with their best judgment and in the manner, they believe to be in the best interest of J & J. |

Can I change my vote after submitting my proxy?

Yes. You can change your vote at any time before your proxy is voted at the Annual Meeting. If you are a shareholder of record, you may revoke your proxy by:

● | submitting a later-dated proxy by mail; or |

● | attending the Annual Meeting via the webcast and voting |

If you hold your shares in street name, you must contact your broker, bank or other nominee regarding how to change your vote.

Can shareholders speak or ask questions at the Annual Meeting?

Yes. J & J encourages shareholders to ask questions or to voice their views. J & J also wishes to assure order and efficiency for all attending shareholders. Accordingly, the Chairman of the Annual Meeting will have sole authority to make any determinations on the conduct of the Annual Meeting, including time allotted for each shareholder inquiry or similar rules to maintain order. Such determination by the Chairman of the Annual Meeting will be final, conclusive and binding. Anyone who is disruptive or refuses to comply with such rules of order will be excused from the Annual Meeting.

Can I attendAttendance at the Annual Meeting?

ShareholdersDue to the continued public health impact of the global COVID-19 pandemic and to support the health and well-being of our employees and shareholders, we are encouragedpleased to personallyprovide shareholders with the opportunity to participate in the Annual Meeting online via the Internet in a virtual-only meeting format to facilitate shareholder attendance and provide a consistent experience to all shareholders regardless of location. We will provide a live webcast of the Annual Meeting at www.virtualshareholdermeeting.com/JJSF2022, where you will also be able to submit questions and vote online. You will need your 16-digit control number included on your proxy card or in the instructions that accompanied your proxy materials. You will not be able to attend the annual Meeting whether or not you utilize proxy voting. meeting at a physical location. Closed captioning will be provided.

If your shares are registered in street name, your method of voting is described above.

Methods of Voting

Shareholders can vote via the Internet during the Annual Meeting webcast or by proxy. There are three ways to vote by proxy:

● | By Telephone – You can vote by calling 1-800-690-6903; |

● | By Internet – You can vote over the Internet at www.proxyvote.com and following the instructions on the proxy card; or |

● | By Mail – If you received proxy materials by mail you can vote by signing, dating and mailing the enclosed proxy card. |

Telephone and Internet voting facilities for stockholders of record will be available 24 hours a day and will close at 11:59 P.M. E.S.T. on February 15, 2022.

PROPOSAL 1

INFORMATION CONCERNING NOMINEE FOR ELECTION TO BOARD

One (1) director is expected to be elected at the Annual Meeting to serve on the Board of Directors of J & J until the expiration of his or her term as indicated below and until his or her successor is elected and has qualified.

The following table sets forth information concerning J & J’s nominee for election to the Board of Directors. If the nominee becomes unable or for good cause will not serve, the persons named in the enclosed form of proxy will vote in accordance with their best judgment for the election of such substitute nominee as shall be designated by the Board of Directors. The Board of Directors of J & J expects the nominee to be willing and able to serve.

| Year of | Year of | |||||||||||||||

| Expiration of | Expiration of | |||||||||||||||

Name | Age | Position | Term as Director | Age | Position | Term as Director | ||||||||||

Gerald B. Shreiber | 78 | Chairman of the Board | 2025 | |||||||||||||

| Chief Executive Officer | |||||||||||||||

| Director | |||||||||||||||

Marjorie S. Roshkoff, Esquire | 53 | Director | 2027 | |||||||||||||

Marjorie S. Roshkoff became a Director in 2020. Since February 2016, she has been In-House Counsel with J & J Snack Foods Corp. and was made a Vice President in 2017 and General Counsel in 2021. She joined the Company in February 2016 with more than 15 years of legal experience. As General Counsel, Ms. Roshkoff oversees outside counsel and is responsible for all of the Company’s legal matters. In addition to her litigation and employment related expertise, she has extensive knowledge of the Company’s history, organization and culture and adds the perspective of a long-term highly committed director, shareholder and employee regarding Board decisions and matters. Ms. Roshkoff is a daughter of Gerald B. Shreiber, the founder of the Company and current Chairman of the Board.

The Board recommends that you vote “FOR” the election of the nominee

INFORMATION CONCERNING CONTINUING

DIRECTORS AND NAMED EXECUTIVE OFFICERS

| Year of Expiration of | |||||||||||||||

Name | Age | Position | Year of Expiration of Term as Director | Age | Position | Term as Director | ||||||||||

Peter G. Stanley | 77 | Director | 2021 | |||||||||||||

Dennis G. Moore | 64 | Senior Vice-President, Chief | 2022 | |||||||||||||

Financial Officer, | ||||||||||||||||

Treasurer and Director | ||||||||||||||||

Gerald B. Shreiber | 80 | Chairman of the Board | 2025 | |||||||||||||

Sidney R. Brown | 61 | Director | 2023 | 64 | Director | 2023 | ||||||||||

| Vincent Melchiorre | 59 | Director | 2024 | 61 | Director | 2024 | ||||||||||

Peter Stanley | 79 | Director | 2026 | |||||||||||||

Daniel Fachner | 59 | President, The ICEE Company | -- | 61 | President, Chief Executive Officer | |||||||||||

Robert M. Radano | 70 | Senior Vice President, Chief | -- | |||||||||||||

Ken A. Plunk | 58 | Senior Vice President, | ||||||||||||||

Operating Officer | Chief Financial Officer | |||||||||||||||

Gerard G. Law | 45 | Senior Vice President, | -- | |||||||||||||

Robert M. Radano (1) | 72 | Senior Vice President, | ||||||||||||||

Assistant to the President | Chief Operating Officer | |||||||||||||||

Robert Pape | 64 | Senior Vice President, Sales | ||||||||||||||

Lynwood Mallard | 53 | Senior Vice President, Chief Marketing Officer | ||||||||||||||

Stephen Every | 59 | Chief Operating Officer, the ICEE Company | ||||||||||||||

Dennis G. Moore (2) | 66 | Former Senior Vice President, | ||||||||||||||

| Former Chief Financial Officer and former Director | ||||||||||||||||

(1) Mr. Radano retired in March 2021.

(2) Mr. Moore retired as Chief Financial Officer in September 2020. Mr. Moore continued to work for the Company until December 2020, and then served in a consulting role until July 2021.

Gerald B. Shreiber is the founder of the Company and has servedserves as itsthe Chairman of the Board,Board. Mr. Shreiber also served as the Company’s President, and Chief Executive Officer since its inception in 1971. In additionMay 2020, Mr. Shreiber stepped down as President of J & J Snack Foods Corp. and in May 2021, he stepped down as the Chief Executive Officer. Mr. Shreiber is the father of Marjorie S. Roshkoff, Esquire, Vice-President, General Counsel and Secretary of the Company, who has been nominated for re-election to his leadership skills asthe Board pursuant to Proposal 1.

Sidney R. Brown is the Chief Executive Officer of NFI Industries, Inc., a global integrated supply chain solutions provider. Mr. ShreiberBrown is also on the Board of FS Investments Energy and Power Fund, a specialty finance company that invests primarily in income-oriented securities of private energy-related companies. In addition, he is a member of the Board of Trustees of Cooper Health Systems, a non-profit provider of health services in Southern New Jersey. Mr. Brown has management experience in running a private company and experience in executing strategic acquisitions. He has broad and vast experience in freight transportation and supply chain solutions. He also has a broad range of experiencestrong background in production,sales, marketing and finance. Also, he hasHe became a deep understandingdirector of J & J’s business and its industry.the Company in 2003.

Vincent Melchiorre is a Senior Vice President of Bimbo Bakeries USA since September 2010. From June 2007 to August 2010, Mr. Melchiorre was employed by J & J Snack Foods Corp. as Senior Vice President – Food Group. From May 2006 to June 2007, he was Senior Vice President, Bread and Roll business, George Weston Foods; fromFoods. From January 2003 to April 2006, he was Senior Vice President, Sales and Marketing at Tasty Baking Company and from June 1982 to December 2002 he was employed by Campbell Soup Company in various capacities, most recently as Vice President of Marketing of Pepperidge Farm. These experiences provide Mr. Melchiorre with an extensive knowledge of the food business including relevant experience in the fresh, frozen and shelf stable segments. In addition, he has had leadership roles in finance, information technology, operations, sales and marketing. Mr. Melchiorre became a director of the Company in August 2013.

Dennis G. MoorePeter Stanley joined the Company in 1984 and has served in various capacities since that time. He was named Chief Financial Officer in 1992 and was elected to the Board of Directors in 1995. His term will expire in 2022.

Sidney R. Brown is the Chief Executive Officer of NFI Industries, Inc., a premier integrated supply chain solutions provider. In December of 2016 Sid stepped down as Chairman of the Board of Directors of Sun National Bank, a national bank operating in New Jersey, Delaware and Pennsylvania. Sid is also on the Board of FS Energy and Power Fund, a specialty finance company that invests primarily in income-oriented securities of private energy-related companies. In addition, he is a member of the Board of Trustees of Cooper Health Systems, a non-profit provider of health services in Southern New Jersey. Mr. Brown has management experience in running a private company and experience in executing strategic acquisitions. He has broad experience in freight transportation. He also has a strong background in sales, marketing and finance. He became a director of the Company in 2003.

Peter G. Stanley became a director in 1983. Since November 1999, he ishas been the Chairman of the Board of Emerging Growth Equities, Ltd., an investment banking firm. Mr. Stanley brings to the Board experience as a commercial and investment banker, with knowledge of strategic acquisitions and corporate finance. He provides the Board with strong financial skills and chairs our Audit Committee.

Daniel Fachner has been an employee of Thethe ICEE Company since 1979 and became its President in August 1997. In May 2020, Mr. Fachner was named President of J & J Snack Foods Corp. and in May 2021 Mr. Fachner was appointed Chief Executive Officer of J & J Snack Foods Corp.

Ken A. Plunk was appointed Senior Vice President and Chief Financial Officer onSeptember 21, 2020. Prior to joining J & J, Mr. Plunk spent 12 years at Walmart Inc. most recently as Senior Vice President of International Finance. Prior to Walmart, he worked at The Home Depot for four years, holding leadership positions in merchandise finance and internal audit.

Robert M. Radano joined the Company in 1972 and in May 1996 was named Chief Operating Officer of the Company. Mr. Radano retired as Chief Operating Officer in March 2021.

Gerard LawRobert Pape joined the Company in 1992.March 1998 as Senior Vice President of Sales and Marketing. Prior to joining the Company Mr. Pape worked for Campbell Soup Company as its National Sales Director. Mr. Pape is retiring from the Company in January 2022.

Lynwood Mallard joined the Company as Senior Vice President and Chief Marketing Officer in March 2021. Prior to joining J & J, Mr. Mallard worked at the Coca-Cola Company since 1998 where he held various ascending roles in areas of brand marketing, strategy, commercialization, and innovation.

Stephen Every was named Chief Operating Officer of the ICEE Company in August 2021. Mr. Every joined the ICEE Company as Director, Special Projects in 2009. In 2012, Mr. Every was promoted to Vice President of Sales with responsibility for the management and development of relationships with many of ICEE’s largest brand and service customers in the USA.

Dennis G. Moore joined the Company in 1984. He served in various manufacturing and sales management capacitiescontrollership functions prior to becoming Senior Vice President, Western Operationsthe Chief Financial Officer in 2009. He was namedJune 1992. Mr. Plunk replaced Mr. Moore as Chief Financial Officer in September 2020. Mr. Moore continued to his present positionwork for the Company until December 2020, and then served in 2011 in which he has responsibility for marketing, research and development and overseeing the manufacturing facilities of J & J.

The Board recommends that you vote “FOR” the election of the nominee.a consulting role until July 2021.

CORPORATE GOVERNANCE

Corporate Governance Guidelines

J & J is a Company incorporated under the laws of the State of New Jersey. In accordance with New Jersey law and J & J’s By-laws, the Board of Directors has responsibility for overseeing the conduct of J & J’s business. J & J has established a Code of Business, Conduct and Ethics which is applicable to all directors, officers and employees of the Company. In addition, the Company has adopted a Code of Ethics for Chief Executive and Senior Financial Officers. Copies of these codes are available on the Company’s website.

Director Independence

The rules of NASDAQ require that a majority of the Company’s Board of Directors and the Membersmembers of the Audit Committee, Compensation Committee and the Nominating/ Governance Committee meet its independence criteria. No director qualifies as independent unless the Board determines that the director has no direct or indirect material relationship with the Company. The Board considers all relevant facts and circumstances of which it is aware in making an independence determination.

Based on the NASDAQ guidelines the Board of Directors has determined that each of the following directors is independent: Sidney R. Brown, Vincent Melchiorre and Peter G. Stanley. Neither Mr. Stanley nor Mr. Melchiorre has a business, financial, family or other type of relationship with J & J. With respect to Mr. Brown’sBrown, his company, NFI Industries, provided transportation and supply chain solutions services to the Company totaling $167,000$540,000 in 2019, $274,980 in 2020 and $633,056 in fiscal 2017, $180,000 in fiscal 2018year 2021. The Board of Directors determined that Mr. Brown is independent irrespective of the services provided due to the relative levels of revenue of J & J and $540,000 in 2019.NFI. As an employee of the Company, the Board of Directors has determined that Ms. Roshkoff is not independent.

Board Meetings

During the fiscal year, the Board of Directors held four regularly scheduled meetings. Each Director attended at least 75% of the total meetings of the Board of Directors and the Committees on which he or she served.

Annual Meeting Attendance

It has been longstanding practice of the Company for all Directors to attend the Annual Meeting of Shareholders. Mr. Brown was unable to attendAll Directors virtually attended the Annual Meeting held in February 2019.2021.

Executive Sessions of Independent Directors

The Independent Directors meet in executive sessions without management present before or after regularly scheduled Board meetings. In addition, the Independent Directors meet at least once annually with the Chief Executive Officer at which time succession issues are discussed.

Director Stock Ownership Guidelines

The Board has established stock ownership guidelines for the non-employee directors. Within two years of election as a director, the director must attain and hold 30003,000 shares of J & J’s Common Stock. All current non-employee directors meet this guideline.

Board Leadership

The Board of Directors has reviewed and discussed the leadership structure.structure at the Company and during fiscal 2021 determined that it would be in the best interests of the Company for the Board of Directors to separate the roles of Chairman of the Board and President and Chief Executive Officer. As of the date of this proxy statement, the offices of Chairman and President and Chief Executive Officer are held by two separate individuals. Mr. Shreiber, serves as both principal executive officer and chairman of the board. Mr. Shreiber is the founder of the Company and has been itssignificant shareholder, serves as Chairman and Mr. Fachner serves as the President and Chief Executive Officer and Chairman since its inception. He currently beneficially owns 19% of the Company. The Board believes the separation of the roles is the most appropriate structure at this time as it allows the Company’s stockPresident and may be deemedChief Executive Officer to be its controlling shareholder. It is Mr. Shreiber’s position, which is shared byfocus primarily on establishing and implementing the Board, that as controlling shareholder who is active in the business, as Mr. Shreiber has been for over the last 48 years, he should hold both roles.Company’s strategic plan and on day-to-day operations.

Board Committees

In order to fulfill its responsibilities, the Board has delegated certain authority to its committees.Committees. There are three standing committees: (i) Audit Committee, (ii) Compensation Committee and (iii) Nominating/Governance Committee. Each Committee has its own Charter which is reviewed annually by each committeeCommittee to assure ongoing compliance with applicable law and sound governance practices. Committee charters may be found on our website at www.jjsnack.com under the “Investors” tab and then under “Corporate Governance”. Paper copies are available at no cost by written request to Marjorie S. Roshkoff, Corporate Secretary, J & J Snack Foods Corp., 6000 Central Highway, Pennsauken, New Jersey 08109. Shareholders may also call Joe Jaffoni, Norberto Aja or Jennifer Neuman at our investor relations firm, JCIR. The telephone number is 212-835-8500 or contact jjsf@jcir.com for a paper copy.

The Audit Committee

The Audit Committee is comprised of directors Mr. Stanley (Chairman), Mr. Brown and Mr. Melchiorre, each of whom qualifies as an independent director and meets the other requirements to serve on the Audit Committee under rules of the NASDAQ Stock Market. The principal functions of the Audit Committee include, but are not limited to, (i) the oversight of the accounting and financial reporting processes of the Company and its internal control over financial reporting; (ii) the oversight of the quality and integrity of the Company’s financial statements and the independent audit thereof; and (iii) the approval, prior to the engagement of, the Company’s independent auditors and, in connection therewith, review and evaluation of the qualifications, independence and performance of the Company’s independent auditors. The Audit Committee convened six (6) times during the 2019 fiscal year.to:

● | The oversight of the accounting and financial reporting processes of the Company and its internal control over financial reporting. |

● | The oversight of the quality and integrity of the Company’s financial statements and the independent audit thereof. |

● | Discussion of the audited financials with the Company’s management. |

● | Recommend to the Company’s Board, as appropriate, that the Company’s audited financial statement be included in the Company’s annual report on Form 10‑K. |

● | The approval, prior to the engagement of, the Company’s independent auditors and, in connection therewith, to review and evaluate the qualifications, independence and performance of the Company’s independent auditors. |

The Audit Committee currently does not have an Audit Committee Financial Expert, as such term is defined in Section 407 of the Sarbanes-Oxley Act of 2002. The Audit Committee believes that the background and experience of its members allow them to perform their duties as members of the Audit Committee. This background and experience include a former banker and currentretired investment banker who regularly reviews financial statements of companies, a Chief Executive Officer of a substantial private company with financial oversight responsibilities who also is a former Chairman of the Board of a National Bank, and a businessman who has had substantial financial oversight responsibilities with food companies.

The Audit Committee held six (6) meetings during the 2021 fiscal year.

The Compensation Committee

The Compensation Committee is comprised of directors Mr. Brown (Chairman) and Mr. Stanley, each of whom qualifies as an independent director under the rules of the NASDAQ Stock Market, as non-employee directors under Rule 16b-3 of the Securities Exchange Act of 1934, and as outside directors under Section 162(m) of the Internal Revenue Service. The Committee has responsibility for the following:

● | Annually review and determine the compensation of the |

● | Review and approve compensation paid to family members of officers and directors. |

● | Determine the Company’s policy with respect to the application of Internal Revenue Code Section 162(m). |

● | Approve the form of employment contracts, severance arrangements, change in control provisions and other compensatory arrangements with officers. |

● | Approve cash incentives and deferred compensation plans for officers (including any modification to such plans) and oversee the performance objectives and funding for executive incentive plans. |

● | Approve compensation programs and grants involving the use of the Company’s stock and other equity securities, including the administration of the |

● | Prepare an annual report on executive compensation for inclusion in the Company’s proxy statement for each annual meeting of shareholders in accordance with applicable rules and regulations. |

● | Retain or obtain the advice of a compensation consultant, legal counsel or other advisor. |

● | Have direct responsibility for the appointment, compensation and oversight of the work of any compensation consultant, legal counsel and other advisor retained by the Compensation Committee. |

● | Monitor compliance with legal prohibitions on loans to directors and officers of the Company. |

● | Review the Committee’s performance annually. |

● | Review and reassess the adequacy of the Committee’s Charter annually and recommend to the Board any appropriate changes. |

● | Perform such other duties and responsibilities as may be assigned to the Committee, from time to time, by the Board. |

The Compensation Committee held one (1) meetingfour (4) meeting(s) during the fiscal 2019.2021 year.

The Nominating Committee

The Nominating and Corporate Governance Committee is comprised of directors Mr. Melchiorre (Chairman), Mr. Brown and Mr. Stanley, each of whom qualifies as an independent director under rules of the NASDAQ Stock Market. This Committee’s primary responsibilities are to (1) maketo:

● | Make recommendations to the Board |

● | Identify individuals qualified to become Board members and recommend to the Board qualified individuals to be nominated for election or appointed to the Board. |

● | Conduct background and qualifications checks of persons it wishes to recommend to the Board as candidates or to fill vacancies. |

● | Recommend to the Board the slate of nominees of directors to be proposed for election by the stockholders and individuals to be considered by the Board to fill vacancies. Approvals should follow a review by the Committee of the performance and contribution of fellow directors as well as the qualifications of proposed new directors. |

● | Establish policies regarding the consideration of director candidates recommended by security holders. |

● | Develop a succession plan for the Company’s Chief Executive Officer. |

● | Develop corporate governance guidelines applicable to the Company. |

The Nominating and committees of the Board, (2) identify individuals qualified to become Board members and recommend to the Board qualified individuals to be nominated for election or appointed to the Board, (3) develop a succession plan for the Company’s Chief Executive Officer and (4) develop corporate governance guidelines applicable to the Company. TheCorporate Governance Committee will consider nominees for directors recommended by stockholders. Any stockholder may recommend a prospective nominee for thesuch Committee’s consideration by submitting in writing to the Company’s Secretary (at the Company’s address set forth below) the prospective nominee’s name and qualifications.

The Nominating and Corporate Governance Committee held one (l) meetingthree (3) meetings during the fiscal 2019. The Nominating Committee has not adopted a policy with regard to the consideration of diversity in identifying director nominees.2021 year.

Shareholder Proposals and Nominations

Any stockholder who wishes to submit a proposal to be voted on or to nominate a person for election to the Board of Directors at the Company’s 2020 annual meetingAnnual Meeting of stockholdersStockholders in 20212023 must notify the Company’s Secretary (at the Company’s address set forth above) no earlier than August 23, 202029, 2022 and no later than September 23, 202028, 2022 (unless the date of the 20202023 annual meeting is more than 30 days before or more than 60 days after February 11, 2021,16, 2023, in which case the notice of proposal must be received (a) not more than 90 days prior to the annual anniversary of the date on which the Company first mailed proxy materials for the 20192022 annual meeting to shareholders, and (b) not earlier than the later of (i) 60 days prior to the annual anniversary of the date on which the Company first mailed proxy materials for the 20192022 annual meeting to shareholders, and (ii) the 10th day following the date on which the Company first publicly announces the date of the 20202023 annual meeting). The notice of a proposal or nomination must also include certain information about the proposal or nominee and about the stockholder submitting the proposal or nomination, as required by the Company’s By-Laws, and must also meet the requirements of applicable securities laws. Proposals or nominations not meeting these requirements will not be presented at the annual meeting.

For more information regarding stockholder proposals or nominations, you may request a copy of the Bylaws from the Company’s Secretary at the Company’s address set forth below.

Communication with The Board

Shareholders, employees and others may contact any of the Company’s Directors by writing to them c/o J & J Snack Foods Corp., 6000 Central Highway, Pennsauken, New Jersey 08109.

Compliance withDelinquent Section 16(a) of the Securities Exchange Act of 193416(a) Reports

Section 16(a) of the Securities Exchange Act of 1934 requires that the Company’s directors and executive officers, and persons who beneficially own more than ten percent of the Company’s Common Stock, file with the Securities and Exchange Commission reports of ownership and changes in ownership of Common Stock and other equity securities of the Company. To the Company’s knowledge, based solely on a review of the copies of such reports furnished to the Company and written representations received by it from such directors and executive officers, all Section 16(a) filing requirements applicable to the Company’s officers, directors and greater than ten-percentten percent (10%) beneficial owners were complied with during fiscal 2019.

Delinquent Section 16(a) Reports

For2021, except a Form 4 for the year ended September 28, 2019, the Form 4s for grantsgrant of options for Messrs. Fachner, Moore, Law and Pape wereawards to Mr. Brown which was filed late.

The Roleof the Board in Risk Oversight

It is the responsibility of the Board to understand and oversee the Company’s strategic plans, and the steps that senior management is taking to manage and mitigate those risks. In the normal course of its business, the Company is exposed to a variety of risks, including marketing and sales, financial reporting and control, information technology, employee matters and legal issues. The identification and understanding of the risks are important in the successful management of the Company. Key management is responsible for the day to day management of the business risks.

Director Compensation

Each non-employee director then serving received on January 1, 2019 2021a payment of $91,000$150,000 (in Company stock or cash at the election of the director) as well as $750 per quarter as a retainer and $1,000 for attendance at each of the Company’s four quarterly Board meetings.. In addition, the Chairman of the Audit Committee receives an annual fee of $10,000.

Non-Employee Director Compensation Table for Fiscal 20192021

| Fees Paid | Fees Paid | Fees Paid | Fees Paid | ||||||||||||

| in Cash | in Stock | in Cash | in Stock | ||||||||||||

Directors | ||||||||||||||||

Sidney R. Brown | $ | 5,250 | $ | 91,000 | $ | 89,263 | $ | 60,737 | ||||||||

Peter G. Stanley | $ | 108,000 | $ | 160,000 | ||||||||||||

Vincent Melchiorre | $ | 98,000 | $ | 150,000 | ||||||||||||

BENEFICIAL OWNERSHIP OF SHARES

The following table sets forth information as of December 13, 201920, 2021 concerning (i) each person or group known to J & J to be the beneficial owner of more than 5%five percent (5%) of Common Stock, (ii) each director of the Company, (iii) the Company’s ChiefNamed Executive Officer, the Chief Financial Officer and the three other most highly compensated executive officers (the “Named Executive Officers”)Officers for the 2019 fiscal year 2021, and (iv) the beneficial ownership of Common Stock by the Company’s directors and all Executive Officers as a group. Except as otherwise noted, each beneficial owner of the Common Stock listed below has sole investment and voting power.

| Shares of | |||||||||||||||||

| Common | |||||||||||||||||

| Shares | Stock | ||||||||||||||||

| Owned | Owned | ||||||||||||||||

Name and Address of Beneficial Owner | Beneficially | Percent of Class (1) | Beneficially | Percent of Class (1) | |||||||||||||

Directors, Nominees and Named Executive Officers | |||||||||||||||||

Gerald B. Shreiber | 3,685,507 | (2)(6) | 19 | % | 3,602,814 | (2)(6) | 19 | % | |||||||||

6000 Central Highway | |||||||||||||||||

Pennsauken, NJ 08109 | |||||||||||||||||

Sidney R. Brown | 13,784 | (7) | * | 14,684 | (7) | * | |||||||||||

Vincent Melchiorre | 3,000 | (3) | * | 3,000 | (3) | * | |||||||||||

Peter G. Stanley | 10,000 | (3) | * | ||||||||||||||

Marjorie S. Roshkoff | 75,334 | (4)(8) | * | ||||||||||||||

Daniel Fachner | 19,786 | (4) | * | ||||||||||||||

Ken A. Plunk | 1,579 | (9) | * | ||||||||||||||

Robert M. Radano | 95,353 | (4)(10) | * | ||||||||||||||

Robert Pape | 6,479 | (4) | * | ||||||||||||||

Steve Every | 2,663 | (4) | * | ||||||||||||||

Lynwood Mallard | -- | ||||||||||||||||

Dennis G. Moore | 89,035 | (4) | * | 63,106 | (11) | * | |||||||||||

Robert M. Radano | 110,967 | (4) | * | ||||||||||||||

Peter G. Stanley | 10,000 | (3) | * | ||||||||||||||

Daniel Fachner | 35,969 | (4) | * | ||||||||||||||

Gerard Law | 37,002 | (4) | * | ||||||||||||||

All executive officers and directors as a group (9 persons) | 4,002,963 | (5) | 21 | % | |||||||||||||

All executive officers and directors as a group (10 persons) | 3,736,339 | (5) | 20 | % | |||||||||||||

| Five percent Shareholders | |||||||||||||||||

| Black Rock Fund Advisors | |||||||||||||||||

Black Rock Fund Advisors (12) | |||||||||||||||||

| 400 Howard Street | |||||||||||||||||

| San Francisco, CA 94105 | 11 | % | 13 | % | |||||||||||||

| The Vanguard Group, Inc. | |||||||||||||||||

The Vanguard Group, Inc. (13) | |||||||||||||||||

| 100 Vanguard Blvd. | |||||||||||||||||

| Malvern, PA 19355-2331 | 9 | % | 9 | % | |||||||||||||

Wells Fargo & Company (14) | |||||||||||||||||

| 420 Montgomery Street | |||||||||||||||||

| San Francisco, CA 94163 | 6 | % | |||||||||||||||

Macquarie Investment Management (15) | |||||||||||||||||

| 100 Independence | |||||||||||||||||

| 610 Market Street | |||||||||||||||||

| Philadelphia, PA 19106-2354 | 5 | % | |||||||||||||||

* Less than 1%

1 %

(1) The securities “beneficially owned” by a person are determined in accordance with the definition of “beneficial ownership” set forth in the regulations of the Securities and Exchange Commission and, accordingly, include securities owned by or for the spouse, children or certain other relatives of such person as well as other securities as to which the person has or shares voting or investment power or has the right to acquire within 60 days of Record Date. The same shares may be beneficially owned by more than one person. Beneficial ownership may be disclaimed as to certain of the securities.

(2) Includes 140,000 shares of Common Stock issuable upon the exercise of options exercisable within 60 days from the date of this Proxy Statement.

(3) Owned jointly with spouse with shared voting.

(4) Includes 16,000 shares32,336 shares of Common Stock issuable upon the exercise of options granted to executive officers of J & J and exercisable within 60 days from the date of this Proxy Statement.

(5) Includes 209,400172,336 shares of Common Stock issuable upon the exercise of options exercisable within 60 days from the date of this Proxy Statement.Statement, and excludes shares owned by Mr. Moore and Mr. Radano.

(6) Includes 3,552,892 shares held in the 2021 Irrevocable Trust for Gerald B. Shreiber. Does not include 261,449289,755 number of shares held in a Foundation of which Mr. Shreiber is a Trustee and who has disclaimed beneficial ownership of such shares.

(7) Does not include 3,6002,600 number of shares held in a Foundation of which Mr. Brown is a Trustee and who has disclaimed ownership of such shares.

(8) Does not include 3,552,892 shares held in The 2021 Irrevocable Trust for Gerald B. Shreiber, for which the Ms. Roshkoff is Trustee, 217,642 shares held in a trust for Ms. Roshkoff and her siblings, IDGT, for which Ms. Roshkoff serves as the Trustee, nor 22,764 shares held by Ms. Roshkoff’s children individually, held in trust or custodian accounts, for each of which Ms. Roshkoff serves as the Trustee or Custodian. Ms. Roshkoff disclaims beneficial ownership of these securities except to the extent of her pecuniary interest therein, and the inclusion of these shares in this report shall not be deemed an admission of beneficial ownership of all of the reported shares for purposes of Section 16 or for any other purpose.

(9) Includes 1,579 granted to Mr. Plunk thirty days after his appointment as Chief Financial Officer, which vest equally over three years.

(10) Mr. Radano retired in March 2021.

(11) Mr. Moore retired as Chief Financial Officer in September 2020. As of November 24, 2020, he owned 63,106 shares.

(12) As reported in Amendment No. 13 to its Schedule 13G filed with the SEC on January 27, 2021. Includes shares beneficially owned by BlackRock Life Limited, BlackRock Advisors, LLC, BlackRock (Netherlands) B.V., BlackRock Fund Advisors, BlackRock Institutional Trust Company, National Association, BlackRock Asset Management Ireland Limited, BlackRock Financial Management, Inc., BlackRock Japan Co., Ltd., BlackRock Asset Management Schweiz AG, BlackRock Investment Management, LLC, BlackRock Investment Management (UK) Limited, BlackRock Asset Management Canada Limited, BlackRock Investment Management (Australia) Limited and BlackRock Fund Managers Ltd.

(13) As reported in Amendment No. 7 to its Schedule 13G filed with the SEC on February 10, 2021. Includes shares beneficially owned by Vanguard Asset Management, Limited, Vanguard Fiduciary Trust Company, Vanguard Global Advisors, LLC, Vanguard Group (Ireland) Limited, Vanguard Investments Australia Ltd, Vanguard Investments Canada Inc., Vanguard Investments Hong Kong Limited and Vanguard Investments UK, Limited.

(14) As reported in its Schedule 13G filed with the SEC on February 11, 2021. Includes shares beneficially owned by Wells Fargo Advisors Financial Network, LLC, Wells Fargo Bank, National Association, Wells Fargo Clearing Services, LLC, Wells Fargo Funds Management, LLC, Wells Fargo Delaware Trust Company, National Association, Wells Capital Management Incorporated.

(15) As reported in its Schedule 13G filed with the SEC on February 12, 2021. Includes shares beneficially owned by Macquarie Group Limited, Macquarie Bank Limited, Macquarie Affiliated Managers (USA) Inc., Macquarie Affiliated Managers Holdings (USA) Inc., Macquarie Americas Holdings Pty Ltd., Macquarie B.H. Pty Limited, Macquarie FG Holdings Inc., Macquarie Funding Holdings Inc., Macquarie Investment Management Limited, Macquarie Investment Management Global Limited, Macquarie Investment Management Australia Limited, Macquarie Investment Management Austria Kapitalanlage AG, ValueInvest LUX.

COMPENSATION DISCUSSION AND ANALYSIS

Introduction:

J & J Snack Foods Corp. manufactures snack foods and frozen beverages which it markets nationally to the food service and retail supermarket industries. Our compensation programs are designed to support our business goals and promote both short-term and long-term growth. This section of the proxy statement explains how our compensation programs are designed and operate in practice with respect to our Named Executive officers. OurFor fiscal year 2021, our Named Executive Officers are the CEO, CFOChief Executive Officer, the former Chief Executive Officer, the Chief Financial Officer, the formerChief Financial Officer and the three most highly compensated executive officers, in a particular year.as well as an officer who retired during fiscal year 2021. The “Executive Compensation” section presents compensation earned by the Named Executive Officers.

Executive Compensation Objectives

Our executive compensation programs reflect our results-oriented corporate culture that rewards achievement of aggressive goals. Our compensation program for executive officers is designed to attract, retain, motivate and reward talented executives who will advance our strategic, operational and financial objectives and thereby enhance stockholder value.

The following principles are considered in setting compensation programs and pay levels:

● | Compensation and benefit programs offered by J & J should appropriately reflect the size and financial resources of our Company in order to maintain long-term viability. These programs should be increasingly market-based (rather than legacy) and competitive, without limiting our ability to adequately invest in our business. This approach supports our efforts to maintain a viable and sustainable enterprise for the future. |

● | Compensation should reward Company and individual performance. Our programs should strive to deliver competitive compensation for exceptional individual and Company performance to companies with whom we compete for executive talent. |

● | Compensation of executive officers should be predominately performance-based. At higher levels in the Company, a greater proportion of an executive’s compensation should be linked to Company performance and stockholder returns. As discussed below, our performance is measured against financial and operational goals and objectives. We also place emphasis on relative performance with our competitor peer group. |

● | The objectives of rewarding performance and retention should be balanced. In periods of temporary downturns in Company performance, particularly when driven by unanticipated industry events or customer decisions, our compensation programs should continue to ensure that high-achieving, marketable executives remain motivated and committed to J & J. This principle is essential to our effort to encourage our leaders to remain with J & J for long and productive careers. |

● | Executive officers should be J & J stockholders. Stock ownership aligns our executive officers’ interest with those of our stockholders. They should be required to maintain ownership of J & J stock at a level appropriate for their position in the company. J & J’s long-term equity-based compensation program should facilitate stock ownership and link a portion of compensation to stock price appreciation. |

Determining Compensation

The Compensation Committee’s process for determining compensation levels for executive officers differs depending upon the compensation element and the position of the individual being considered. For each executive officer, other than the CEO;Chief Executive Officer, the Compensation Committee annually reviews each element of compensation described below in consultation with the CEO.Chief Executive Officer. With respect to the Chief Executive Officer, the Compensation Committee assesses the annual Company and individual performance. A number of factors are considered in determining individual compensation level, including performance of the individual and the business unit or function under his or her leadership, the Company’s performance, and economic and business conditions affecting J & J at the time of the review. Management and external sources provide relevant information and analyses as the Compensation Committee deems appropriate. Competitive market data (compensation of 100 local Philadelphia Companies) is considered from time to time, but we need not set compensation levels at a targeted percentile or rely solely on such data to make compensation decisions. While substantially guided by the applicable performance metrics of our programs, the Compensation Committee retains authority to exercise its judgment when approving individual awards. The Committee does not engage in the benchmarking of total compensation or any material component thereof.

With respect to the CEO,In fiscal year 2021, the Compensation Committee, meetswith the approval of the Board engaged a compensation consultant, Pearl Meyer, to assessprovide competitive market information around executive and non-employee director compensation for select positions. Pearl Meyer benchmarked compensation in several executive positions including market data for base salary, annual incentives long term incentives and target total Director compensation. Pearl Meyer used a peer group of 15 publicly traded consumer staple goods (soft drinks, packaged foods, food distributors) companies with revenues between $500 million and $2.4 billion.

In determining to engage Pearl Meyer, the Compensation Committee considered the independence of Pearl Meyer, taking into consideration relevant factors, including the absence of other services provided to the Company by Pearl Meyer, the amount of fees the Company paid to Pearl Meyer as a percentage of Pearl Meyer’s total revenue, the policies and procedures of Pearl Meyer that are designed to prevent conflicts of interest, any business or personal relationship of the individual performance.compensation advisors employed by Pearl Meyer with any executive officer of the Company, any business or personal relationship the individual compensation advisors employed by Pearl Meyer have with any member of the Compensation Committee, and any stock of the Company owned by Pearl Meyer or the individual compensation advisors employed by Pearl Meyer. The Compensation Committee determines Mr. Shreiber’s base salaryhas determined, based on its analysis and in light of all relevant factors, including the factors listed above, that the work of Pearl Meyer and the individual compensation advisor employed by Pearl Meyer as a compensation consultant to the Compensation Committee in its discretion, considers relevanthas not created any conflicts of interest, and inthat Pearl Meyer is independent pursuant to the best interest of J & J. Mr. Shreiber’s bonus was determined by a formula approved by J & J’s stockholders. The Compensation Committee granted Mr. Shreiber the stock options in accordance with a formulaindependence standards set forth in Nasdaq’s continued listing requirements promulgated pursuant to Section 10C of the Stock Option Plan approved by the stockholders.Exchange Act.

J & J’s policies are generally not to have employment contracts or change in control provisions for its executive officers. Its five named executive officers have an average of over 37 years’ service with the Company. None of these officers have employment contracts or change-in-control provisions. This substantial long-term commitment is also demonstrated in this group’s significant ownership of Company stock.

Annual Cash Incentive

The Annual Cash Incentive or Bonus for each Named Executive Officer is handled in a variety of ways. Certain executives are governed by various formula described below which have been developed over the years. The Compensation Committee reviews the formula annuallydetermines bonuses based on Company and has determined that it is producing results that it considers fair and appropriate.individual performance.

Gerald B. Shreiber - CEO.Shreiber. At our 2004 Annual Meeting, the Shareholdersshareholders approved a bonus formula for Mr. Shreiber whereby he receives annually a bonus equal to 2.5 percent of the Company’s Net Earnings. This formula produced a bonus of $1,979,342 in fiscal year 2017. The Compensation Committee did not follow this formula for 2018. Mr. Shreiber’s bonus for fiscal year 20182019 due to the benefits of $1,998,356 was determined independently of the formula because of the large tax benefit the Company received in 2018 resulting from the Tax Cuts and Jobs Act of 2017. This resulted in Mr. Shreiber receiving a lesser bonus than he would have had the Company followed the pre-approved formula. For fiscal yearIn 2019, Mr. Shreiber’s bonus was $2,270,469, which was again less than the pre-approved formula. Mr. Shreiber gave up his remaining salary for the year 2020 beginning in April 2020 in light of the global COVID-19 pandemic. He received a bonus of $457,604 in accordance with the formula set forth above for fiscal year 2020. For fiscal year 2021, Mr. Shreiber did not receive any salary, but did receive a grant of options.

Prior to assuming the role of Chief Executive Officer , Mr. Fachner’s annual bonus was aligned with his prior role and responsibilities. Upon promotion to the role of Chief Executive Officer, in recognition of Mr. Fachner’s increased duties and role as Chief Executive Officer of J & J, the Compensation Committee approved a bonus of $900,000 for Mr. Fachner.

Ken A. Plunk was appointed Senior Vice President, CFO on September 21, 2020. Based on Company performance, as well as his own performance, for fiscal 2021, the Compensation Committee approved a bonus of $375,000 for Mr. Plunk.

Robert Pape, Senior Vice President Sales, received a bonus that was discretionary based on Company and individual performance.

Stephen J. Every was appointed Chief Operating Officer of the ICEE Company in August 2021. He is entitled to a quarterly bonus which is dependent upon meeting certain income goals and can be adjusted as determined by the President. Mr. Every received a bonus of $42,000 in fiscal year 2021.

Lynwood Mallard was appointed Senior Vice President and Chief Marketing Officer in March 2021. In fiscal year 2021, he was entitled to a bonus equal to 40% of his annual salary, prorated based on his hire date. Mr. Mallard received a bonus of $58,000 in fiscal year 2021.

Robert Radano, the former Senior Vice President and Chief Operating Officer who retired in March 2021, did not receive a bonus in fiscal year 2021.

Dennis G. Moore’s,Moore, former Senior Vice President and CFO, bonus is not determined by formula. In determining his bonus, the Compensation Committee periodically reviews the pay forformer Chief Financial Officers included in the Philadelphia Business Journal report on the 100 largest public companies in the region. The CommitteeOfficer did not use this information to create any specific comparison groups or asreceive a benchmarking tool when determining any specific individual’s compensation, including Mr. Moore. The Committee also considers the recommendation of the CEO and the annual results of the Company.

Robert Radano, Senior Vice President and COO, has a target bonus of 50% to 70% of his base compensation. His bonus is subjective and based upon his performance. The committee also considers the recommendation of the CEO.in fiscal year 2021.

Daniel Fachner’s annual bonus is equal to two percent (2%) of the ICEE Company’s earnings before taxes and foreign currency adjustments.

Gerard Law’s annual bonus is subjective and based upon his performance of the varying duties to which he is assigned.

Long-Term Incentives

Long-term incentive compensation is designed to:

• align executive officer and stockholder interests;

• facilitate stock ownership among executive officers;

• reward achievement of long-term performance goals; and

• provide incentives for executive retention;

TheHistorically, the Compensation Committee’s decision to limitCommittee has limited the use of long-term compensation to the stock options described below is because the Named Executive Officers have already accumulated substantial stock ownership over their long periods of service. Asoptions. During fiscal 2021, as a result compensationof approval of the Named Executive Officers is primarily current compensation. TheCompany’s Amended and Restated Long Term Incentive Plan, the Compensation Committee did nothas begun to consider anythe grant of other formstypes of incentive awards including performance stock units and restricted stock.

In the first quarter of fiscal year 2022, the Compensation Committee made changes to our executive long-term compensation plan to grant half of our long-term incentives in the form of performance-based equity. Beginning in fiscal year 2022, the Compensation Committee has granted a mix of long-term incentives, since its opinion is that50% in the form of restricted stock option grantsunits (“RSUs”) and 50% in the form of performance share units (“PSUs”). The restricted stock awards generally vest in equal annual installments, subject to continued employment, over three years. The PSUs are sufficient long-term incentives.earned based on continued employment and financial performance. PSUs may be earned between 50% of the target level for threshold performance and up to 200% of the target level for maximum or above performance, based on the Company’s financial performance. The PSUs are forfeited in the case of performance below the threshold amount.

The terms of the long-term incentive awards granted to Named Executive Officers are described in the narrative to Summary Compensation Table and Grants of Plan-Based Awards table. In accordance with the Stock Option Plan, Mr. Shreiber’s options are granted at the end of the Company’s fiscal year. With the exception of options granted to recently hired employees at time of hire or to employees hired in connection with an acquisition, stock options have usually been granted annually. On May 14, 2019 the Board issued options to various employees at that date’s closing price.

Benefits

Our Named Executive Officers participate in the full range of benefit and retirement plans provided to all salaried employees. These include health and welfare benefits, our 401(k)401(K) plan and our Stock Purchase Plan.

Perquisites

J & J provides a limited number of perquisites to its Named Executive Officers. The most significant of these perquisites to the Named Executive Officers is the use of a Company automobile. Mr. Fachner is provided withreceives an allowance to defray the cost of his Country Club membership.

Tax and Accounting Considerations

Pursuant to the Tax Cuts and Jobs Act of 2017 compensation over $1 million to our executives is not deductible. Prior to 2018, compensation to Mr. Shreiber over $1 million was deductible under Section 162(m) of the Code, as his bonus formula was approved as performance based compensation by shareholders in 2004.

Accounting for Stock-Based Compensation. Stock-based compensation expense for all share-based payment awards is based on the grant date fair value.

CEO Pay Ratio

Under rules adopted pursuant to the Dodd-Frank Act of 2010, the Company is required to calculate and disclose the total compensation paid to its median paid employee, as well as the ratio of the total compensation paid to the median employee as compared to the total compensation paid to the Company’s CEO.

Measurement DateChief Executive Officer.

We identified the median employee using our employee population on June 20192021 and total year-to-date compensation for all employees, excluding the Company’s CEO.Chief Executive Officer.

Median annual total compensation of all employees | ||||

(excluding Mr. Shreiber) | $ | 41,315 | ||

Annual total compensation of Mr. Shreiber, CEO | $ | 4,207,839 | ||

Ratio of Mr. Shreiber’s annual total compensation to the median of all employees | 102:1 | |||

Median annual total compensation of all employees (excluding Mr. Fachner) | $ | 39,852 | ||

Annual total compensation of Mr. Fachner, CEO | $ | 1,493,218 | ||

Ratio of Mr. Fachner’s annual total compensation to the median of all employees | 37:1 |

Policy on Claw Backs

The Company does not presently havehas a policy providing foron Claw Backs. Under such policy a Claw Back review may be initiated as a result of any suspected non-compliance, which includes, but is not limited to:

• fraud, money laundering, bribery, corruption or other form of misconduct;

• any restatement of financial reports as a result of any misconduct;

• any act causing reputational harm to the recoveryCompany or its business activities;

• any other grossly negligent acts or omissions of awardsexecutives, including a failure to supervise in appropriate circumstances;

• failure to identify, raise or payments ifassess in a timely manner any risks or concerns material to the relevant performance measures upon which they are based are restatedCompany, its business activities or its reputation; and

• any other violation of the Company's General Code of Ethics.

Policy Against Hedging

The Board of Directors also unanimously adopted an Anti-Hedging Policy in 2020. Under such policy Executive Officers and Directors of the Company and its subsidiaries shall not, unless previously approved by the Nominating and Governance Committee of the Board, directly or indirectly:

• Purchase any financial instrument, or enter into any transaction, that is designed to hedge or offset a decrease in the market value of Company stock (including, but not limited to, prepaid variable forward contracts, equity swaps, collars or exchange funds); or

• Hypothecate, or otherwise adjustedencumber shares of Company stock as collateral for indebtedness. This prohibition includes, but is not limited to, holding such shares in a manner that would reduce the size of an award or payment. The SEC has proposed a rule on claw backs, which has not been finalized. This proposed rule requires implementing action by NASDAQ. Once NASDAQ has adopted final guidance, the Company plans to adopt a policy to comply. margin account.

Compensation Committee Interlocks and Insider Participation

No member of our Compensation Committee has served as one of our officers or employees at any time. None of our executive officers serves as a member of the compensation committee of any other company that has an executive officer serving as a member of the Board. None of our executive officers serves as a member of the board of directors of any other company that has an executive officer serving as a member of our Compensation Committee.

Report of the Compensation Committee

The Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis required by Item 402(b) of Regulation S-K with management and, based on such review and discussions, the Compensation Committee recommended to the Board that the Compensation Discussion and Analysis be included in this Proxy Statement.

Compensation Committee of the Board of Directors

Directors:

Sidney R. Brown, Chairman

Peter G. Stanley

Vincent Melchiorre

EXECUTIVE COMPENSATION

SUMMARY COMPENSATION TABLE

The following table summarizes compensation paid or earned for the three fiscal years ended September 28, 201925, 2021 for the Company’s ChiefNamed Executive Officer, Chief Financial Officer and the three other most highly compensated executive officers (the “Named Executive Officers”).Officers.

Name and Principal Position |

Year |

Salary $ |

Bonus $ | Option Awards ($) (1) | All Other Compensation $ (2) |

Total $ | ||||||||||||||||

| Gerald B. Shreiber | 2019 | 950,000 | 2,270,469 | 977,600 | 9,770 | 4,207,839 | ||||||||||||||||

| Chairman of the Board | 2018 | 925,000 | 1,998,356 | 924,200 | 11,006 | 3,858,562 | ||||||||||||||||

| Chief Executive Officer | 2017 | 917,308 | 1,979,342 | 734,400 | 11,264 | 3,642,314 | ||||||||||||||||

| Director | ||||||||||||||||||||||

Robert M. Radano | 2019 | 400,383 | 216,300 | 210,320 | 15,625 | 842,628 | ||||||||||||||||

| Senior Vice President | 2018 | 400,305 | 216,300 | 189,440 | 16,387 | 822,432 | ||||||||||||||||

| Chief Operating Officer | 2017 | 408,003 | 216,300 | 150,720 | 16,079 | 791,102 | ||||||||||||||||

| Dennis G. Moore | 2019 | 465,820 | 286,400 | 210,320 | 9,850 | 972,390 | ||||||||||||||||

| Senior Vice President | 2018 | 445,154 | 286,400 | 189,440 | 10,246 | 931,240 | ||||||||||||||||

| Chief Financial Officer | 2017 | 439,687 | 286,400 | 150,720 | 12,596 | 889,403 | ||||||||||||||||

| Treasurer | ||||||||||||||||||||||

| Director | ||||||||||||||||||||||

| Daniel Fachner | 2019 | 400,000 | 643,119 | 210,320 | 24,565 | 1,278,004 | ||||||||||||||||

| President | 2018 | 392,317 | 602,120 | 189,440 | 23,087 | 1,206,964 | ||||||||||||||||

| The ICEE Company | 2017 | 401,969 | 548,440 | 150,720 | 23,799 | 1,124,928 | ||||||||||||||||

| Gerard Law | 2019 | 436,942 | 375,000 | 210,320 | 12,300 | 1,034,562 | ||||||||||||||||

Senior Vice President, | 2018 | 395,192 | 275,000 | 189,440 | 12,360 | 871,992 | ||||||||||||||||

Assistant to the President | 2017 | 353,269 | 250,000 | 150,720 | 12,966 | 766,955 | ||||||||||||||||

Name and Principal | Stock | Option | All other | ||||||||||||||||||||||

Position | Year | Salary ($) | Bonus ($) | awards $ | awards ($) (1) | compensation ($) (2) | Total ($) | ||||||||||||||||||

Gerald B. Shreiber | 2021 | - | - | - | 560,600 | 699 | 561,299 | ||||||||||||||||||

2020 | 498,077 | 457,604 | - | - | 8,434 | 964,115 | |||||||||||||||||||

2019 | 950,000 | 2,270,469 | - | 977,600 | 9,770 | 4,207,839 | |||||||||||||||||||

Daniel Fachner | 2021 | 575,692 | 900,000 | - | - | 17,526 | 1,493,218 | ||||||||||||||||||

2020 | 408,308 | 643,119 | - | 171,840 | 16,517 | 1,239,784 | |||||||||||||||||||

2019 | 400,000 | 643,119 | - | 210,320 | 24,565 | 1,278,004 | |||||||||||||||||||

Ken Plunk | 2021 | 455,000 | 375,000 | 207,749 | (3) | - | 2,412 | 1,040,161 | |||||||||||||||||

2020 | 8,750 | - | - | - | - | 8,750 | |||||||||||||||||||

Robert Pape | 2021 | 282,753 | 54,438 | - | - | 11,646 | 348,837 | ||||||||||||||||||

2020 | 279,528 | 44,300 | - | 38,664 | 11,907 | 374,399 | |||||||||||||||||||

Stephen Every (7) | 2021 | 245,785 | 42,000 | - | - | 10,183 | 297,968 | ||||||||||||||||||

Lynwood Mallard (6) | 2021 | 139,423 | 58,000 | - | - | 663 | 198,086 | ||||||||||||||||||

Robert Radano (4) | 2021 | 253,928 | - | - | - | 9,529 | 263,457 | ||||||||||||||||||

2020 | 400,305 | 173,040 | - | 114,560 | 11,904 | 699,809 | |||||||||||||||||||

2019 | 400,383 | 216,300 | - | 210,320 | 15,625 | 842,628 | |||||||||||||||||||

Dennis Moore (5) | 2021 | 155,911 | - | - | - | 58,735 | 214,646 | ||||||||||||||||||

2020 | 465,940 | 229,120 | - | - | 10,759 | 705,819 | |||||||||||||||||||

2019 | 465,820 | 286,400 | - | 210,320 | 9,850 | 972,390 | |||||||||||||||||||

----------------------------------

(1) The value of the option awards equals their grant date fair value as computed in accordance with FASB ASC Topic 718. For a discussion of the assumptions made in the valuation of the option awards in this column, please refer to Note A.13 to the financial statements included as part of our Annual Report on Form 10-K for the fiscal year ended September 28, 2019.25, 2021.

(2) Includes use of Company automobiles, 401(k) match, andgroup term life insurance, membership fees at a local country club for Mr. Fachner.Fachner, and consulting fees paid to Mr. Moore.

(3) In October 2020, Mr. Plunk received 1,579 shares issued pursuant to an Inducement Restricted Stock Award Agreement with such shares vesting over three (3) years in equal installments.

(4) Mr. Radano retired March 2021.

(5) Mr. Moore retired as Chief Financial Officer in September 2020. Mr. Moore continued to work for the Company until December 2020, and then served in a consulting role until July 2021.

(6) Mr. Mallard was appointed Senior Vice President and Chief Marketing Officer in March 2021.

(7) Mr. Every was promoted to Chief Operating Officer of the ICEE Company in July 2021.

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END

| OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END | ||||||||||||||||||||||||||||||

Option Awards | Stock Awards | |||||||||||||||||||||||||||||

Name | Grant Date | Number of Securities Underlying Unexercised Options (#) Exercisable | Number of Securities Underlying Unexercised Options (#) Unexercisable | Option Exercise Price $ | Option Expiration Date | Number of Shares or Units That Have Not Vested (#) | Market Value of Shares or Units of Stock That Have Not Vested ($) | Equity in Entire Plan Awards: Number of Unearned Shares, Units or Other Rights that Have Not Vested (#) | Equity Incentive Plan Awards: Market or Payment Value of Unearned Shares, Units or Other Rights That Have Not Vested ($) | |||||||||||||||||||||

Gerald B. Shreiber | 9/29/2012 | 20,000 | 57.33 | 9/28/2022 | ||||||||||||||||||||||||||

9/27/2013 | 20,000 | 80.79 | 9/26/2023 | |||||||||||||||||||||||||||

9/26/2014 | 20,000 | 94.24 | 9/25/2024 | |||||||||||||||||||||||||||

9/26/2015 | 20,000 | 117.85 | 9/27/2025 | |||||||||||||||||||||||||||

9/23/2016 | 20,000 | 119.44 | 9/22/2026 | |||||||||||||||||||||||||||

9/29/2017 | 20,000 | 131.30 | 9/28/2027 | |||||||||||||||||||||||||||

9/28/2018 | 20,000 | 150.89 | 9/27/2028 | |||||||||||||||||||||||||||

9/27/2019 | 20,000 | 191.40 | 9/27/2029 | |||||||||||||||||||||||||||

9/24/2021 | 20,000 | 153.65 | 9/23/2031 | |||||||||||||||||||||||||||

Daniel Fachner | 3/13/2018 | 8,000 | 141.01 | 3/12/2023 | ||||||||||||||||||||||||||

5/14/2019 | 8,000 | 163.29 | 5/13/2024 | |||||||||||||||||||||||||||

5/21/2020 | 12,000 | 125.83 | 5/20/2025 | |||||||||||||||||||||||||||

Ken Plunk | 10/20/2020 | 1,579 | (1) | 242,613 | ||||||||||||||||||||||||||

Robert M. Radano | 2/15/2017 | 8,000 | 129.26 | 2/14/2022 | ||||||||||||||||||||||||||

3/13/2018 | 8,000 | 141.01 | 3/12/2023 | |||||||||||||||||||||||||||

5/14/2019 | 8,000 | 163.29 | 5/13/2024 | |||||||||||||||||||||||||||

5/21/2020 | 8,000 | 125.83 | 5/20/2025 | |||||||||||||||||||||||||||

Robert Pape | 2/15/2017 | 2,700 | 129.26 | 2/14/2022 | ||||||||||||||||||||||||||

3/13/2018 | 2,700 | 141.01 | 3/12/2023 | |||||||||||||||||||||||||||

5/14/2019 | 2,700 | 163.29 | 5/13/2024 | |||||||||||||||||||||||||||

5/21/2020 | 2,700 | 125.83 | 5/20/2025 | |||||||||||||||||||||||||||

Stephen Every | 2/15/2017 | 727 | 129.26 | 2/14/2022 | ||||||||||||||||||||||||||

3/13/2018 | 1,500 | 141.01 | 3/12/2023 | |||||||||||||||||||||||||||

5/14/2019 | 1,500 | 163.29 | 5/13/2024 | |||||||||||||||||||||||||||

5/20/2020 | 2,000 | 125.83 | 5/19/2025 | |||||||||||||||||||||||||||

Lynwood Mallard | - | - | ||||||||||||||||||||||||||||

| Option Awards | ||||||||||||||||||

| Name |

Grant Date | Number of Securities Underlying Unexercised Options (#) Exercisable | Number of Securities Underlying Unexercised Options (#) Unexercisable | Option Exercise Price $ | Option Expiration Date | |||||||||||||

| Gerald B. Shreiber | 09/27/10 | 20,000 | 41.75 | 09/26/20 | ||||||||||||||

| 09/24/11 | 20,000 | 47.59 | 09/23/21 | |||||||||||||||

| 09/29/12 | 20,000 | 57.33 | 09/28/22 | |||||||||||||||

| 09/27/13 | 20,000 | 80.79 | 09/26/23 | |||||||||||||||